BIBF-AUB Navigate the LIBOR Transition in a High-Level Webinar

Wednesday, February 24, 2021

The Bahrain Institute of Banking and Finance (BIBF) in collaboration with Ahli United Bank (AUB) organised a high-level webinar on LIBOR Transition on Wednesday, 24th February 2021, to discuss the impact of the transition on financial institutions in Bahrain.

By 31st of December 2021, the financial services sector will witness a shift towards new Risk-Free Rates (RFRs) as the global interest rate benchmark and the phase out of Interbank Offered Rates (IBORS) such as ‘London Interbank Offered Rates’ (LIBOR) – reference rates or benchmarks used in financial transactions to indicate the cost of funds to market participants, which have been under challenge for some time.

IBORs currently act as a fundamental component of the sector as we know it today. The transition away from it will not be an easy one as it will impact numerous functions, from processes and systems, to businesses, client contracts, customer exposures and counterparties.

Markets across the globe have administered extensive analysis to reform their existing rates, with some jurisdictions identifying and adopting Alternative Reference Rates (ARRs) as an alternative for IBORS – although, different jurisdictions are at different stages of progress and implementation.

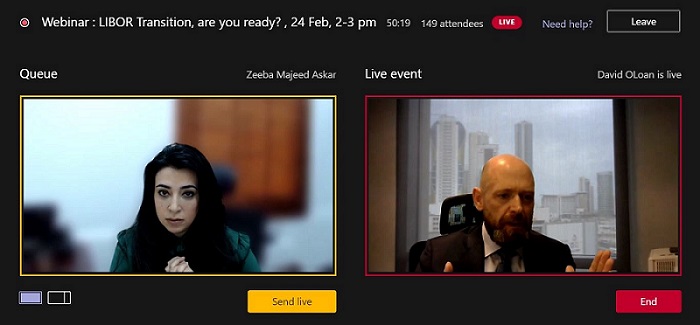

Targeting senior executives from various sectors, the webinar hosted leading industry experts in a panel discussion including Zeeba Askar, Head of Banking & Finance Centre – BIBF, David O’Loan, Deputy Group CEO (Treasury & Investment) – Ahli United Bank (AUB), and Martyn Hoccom, Group Treasurer – First Abu Dhabi Bank (FAB).

The panelists discussed key topics including, reasons behind the cessation of LIBOR, alternatives to LIBOR, and product pricing going forward. The core differences between IBOR and new Alternative Reference Rates (ARR) has also been analysed, considering the main concerns and risks of the transition globally and whether derived rates like BHIBOR and KIBOR will be impacted.